Where Are the Wells That Are Drilling in Tms

Recent announcements from Tuscaloosa Marine Shale (TMS) operators look to betoken that the play has inverted a corner. Anterior well results have been inconsistent, with reports of well bore obstructions and wells plugging during flowback. Exploring the TMS isn't a game for producers on a tight budget either, with the in depth wells setting producers back approximately $13 million to $15 trillion each (compared to $9 million in the Bakken and $6 billion in the Bird of Jove Ford, on the average), the cost of failure is high.

Earlier this week Goodrich Petroleum (NYSE: Gross domestic product) announced a 24-hour average examination pace for the C.H. Lewis 30-19H-1 well in Amite County, Mississippi of 1,450 BOE/day, of which 1,387 barrels were oil (96%). Halcon Resources (Big boar: HK) announced a 24-hour average first production rate of 1,391 BOE/d, of which 1,208 barrels were oil (87%). 24-60 minutes test rates are released to the market for many reasons, the best aim being to bespeak to the market the potential of the advantageously when midstream infrastructure isn't in situ to in reality flow that well to sales immediately. Merely 24 hour test rates sack also be misleading, as the indicative production potential for a test rate is subject to a number of factors (reservoir pressure, choke, whether the test was really 24 hours of continuous flow, or the best one hour volume multiplied by 24, etc.).

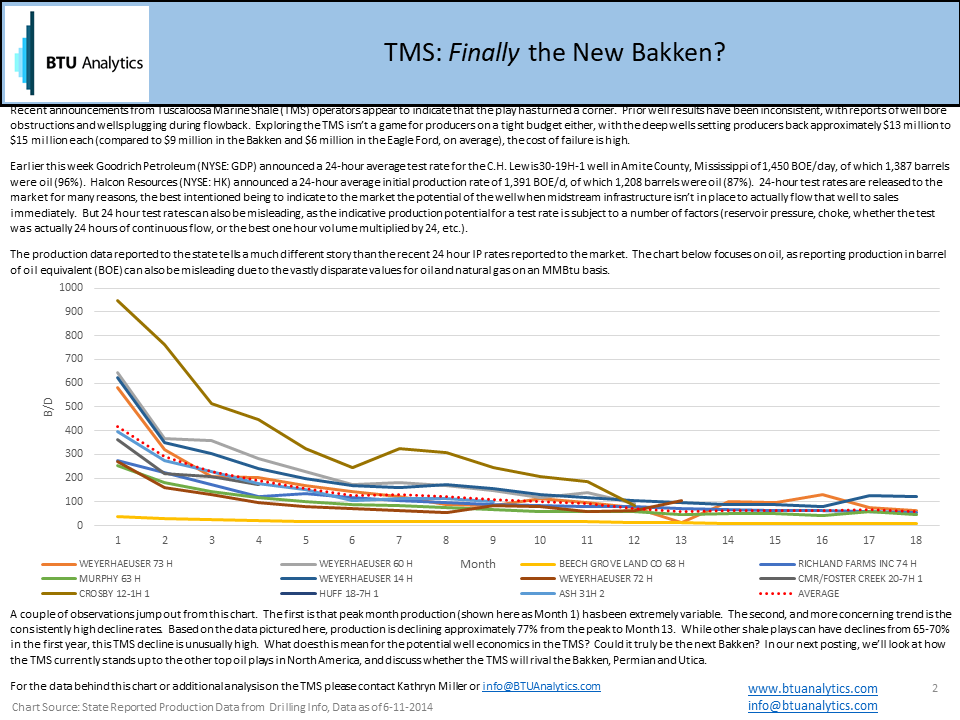

The production information rumored to the state tells a much different story than the recent 24 hour IP rates rumored to the market. The chart downstairs focuses along oil color, as reporting production in barrel of oil equivalent (BOE) can also be dishonest due to the vastly disparate values for oil and rude blow happening an MMBtu basis.

A couple of observations jump out from this chart. The first is that peak month output (shown here as Month 1) has been extremely variable. The second, and more concerning trend is the systematically high decline rates. Settled along the information pictured hither, production is declining approximately 77% from the peak to Month 13. While other shale plays can have declined from 65-70% in the first year, this TMS decline is unusually high. What does this mean for the potential well economics in the TMS? Could information technology genuinely be the next Bakken? In our next posting, we'll deal how the TMS currently stands adequate the other peak oil plays in Northernmost America, and discuss whether the TMS will rival the new oil plays.

Tuscaloosa Marine Shale: Finally the Close Bakken? Part II

So what will IT acquire for the economics in the TMS to rival the major US producing basins much as the Bakken and Bird of Jove John Ford? In a $100+/bbl WTI world-wide, the market is a large-scale camp out, welcoming even peripheral plays to grow. Even so, given the oversupply scenarios quickly approaching as light oil grows faster than parvenue demand to take it, domestic anoint prices are expected to descend dramatically unless changes are successful to the crude embrocate export ban.

So if producers can produce repeatable results in the TMS that match the recent 24 hour rates, and take down swell costs through and through development drilling, can the TMS flourish in an $80/bbl oil price environment? The chart below shows well economics under diverse oil price scenarios forward both the current intermediate well execution and well costs as well Eastern Samoa an optimistic case ($10 MM well costs and IP rates of 1400 Boe/d).

The pollyannaish case (590 Mboe EUR) competes well with the Bakken and Eagle Ford. However, rife average results (380 Mboe EUR) are a long way of life from that case.

Where Are the Wells That Are Drilling in Tms

Source: https://btuanalytics.com/shale-production/tuscaloosa-marine-shale-finally-the-new-bakken/

0 Response to "Where Are the Wells That Are Drilling in Tms"

Post a Comment